Bank Of Canada Tapering

More tapering on the way as markets ramp up rate hike bets In its last set of forecasts the Bank of Canada had predicted that its benchmark rate might need to be raised sometime in the second. Ad Préparez votre arrivée au Canada.

View Bank Of Canada Holds Interest Rate Says It Will Curb Bond Purchases Reuters

Profitez dun an de service daccompagnement gratuit.

Bank of canada tapering. They will be looking for exits as soon as it feels safe to do so. BENGALURU June 2 Reuters - The Bank of Canada will taper its asset purchase programme again. The reason why we suspect the BoC will refrain from going big with its tapering.

Although the Markit Manufacturing PMI for August was slightly better than July 572 vs 562 the data from July was mixed with the Employment Change at 94000 vs 230700 in June. Reuters Wednesday June 02 2021 1408. Soyez prêt pour votre nouvelle vie.

Tapering bond purchases by 3 billion a week. The committee said that they expect inflation to stay above 3 within the short. Bank of Canada policy decision.

The Canadian economys recovery is well underway and that means easy money may be on the way out. The Bank of Canada will announce its latest policy decision on Wednesday at 1400 GMT and is widely expected to move a step closer towards winding down its pandemic-era stimulus. Having been the first major central bank to begin tapering earlier this year the BoC has lost the race to be.

Profitez dun an de service daccompagnement gratuit. Swaps trading suggests investors are fully pricing in a hike over the next 12 months and a total of four over the. Bank of Canada to taper asset purchases again next quarter.

As the market expected the BOC became the first major central bank to announce a tapering of its quantitative easing program starting with a C1. Bank Of Canada To Raise Interest Rates Before Tapering Bond Purchases. Advertisment The Bank of Canada has released its first guidance on how it.

The central bank is certain to hold its key overnight interest rate at 025 per cent but traders increasingly expect it will begin raising rates in the next year. One of this weeks most interesting economic events was yesterdays Bank of Canada BOC monetary policy decision. The Bank of Canada which already holds over 40 of all outstanding Government of Canada GoC bonds compared to the Fed which holds less than 18 of all outstanding US Treasury securities announced today that it would reduce by one-quarter the amount of GoC bonds it adds to its pile from C4 billion per week currently to C3 billion per week beginning April 26.

Risk of The Bank of Canada Not Tapering QE Soon Is Rising. Bank of Canada BoC updated its outlook earlier today. Everything you need to know about the Bank of Canada However when the BOC meets on Wednesday they may consider a delay in their tapering until the next meeting on October 18 th.

At the last Bank of Canada meeting on July 14th the BOC tapered bond purchases from C3 billion per week to C2 billion per week because the financial institution felt the economy would still strengthen. The Bank of Canada has decided to reduce the pace of its bond purchases. Markets are likely fully factoring in C1bn per week worth of tapering by the Bank of Canada this week and we think that it may not deviate much from expectations.

The central bank said the accelerated recovery will allow them to ease stimulus. Bank of Canada policy meeting. Bank of Canada Tapers Quantitative Ease By 25 Rate Hikes May Come In 2022.

Bank of Canada to taper asset purchases again next quarter. Experts expect QE to taper soon but RBC sees a risk of delay materializing. The Bank of Canada also denied initially it was tapering The Bank of Canada which now has a super-mega housing bubble on its hands blazed the trail last October when it announced that it would taper its purchases of Government of Canada bonds from C5 billion a week to C4 billion a week and that it would stop buying MBS altogether.

That matters for markets because it. Ad Préparez votre arrivée au Canada. Canada Is Tapering Bond Purchases.

The Bank of Canada BoC will set its policy on Wednesday at 1400 GMT two days after. The Bank of Canadas current economic forecast suggests the economy wont fully recover from the effects of COVID-19 lockdowns until 2023 so there is little reason to fret about tighter monetary policy anytime soon. The Bank of Canada takes a hawkish turn as it tapers its quantitative easing program by more than the market expected.

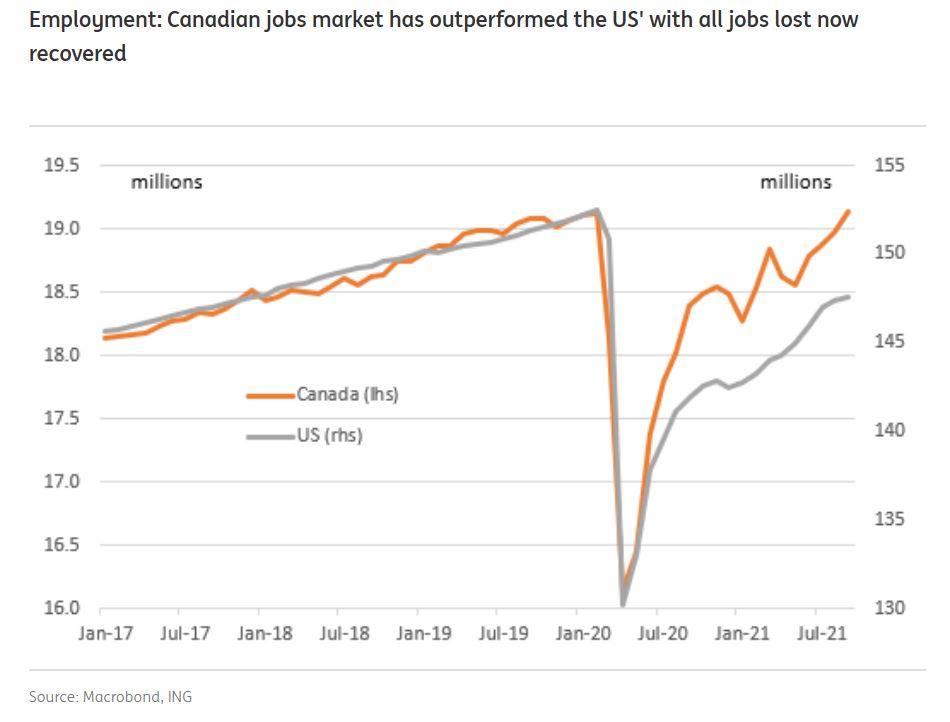

A bond tapering story. We continue to see risk that the BoC delays its next QE tapering step to 1B per week from 2B currently beyond October said Nye to clients. The tapering in asset purchases comes amid a slew of positive economic news for Canada including improvements in the countrys labor market GDP gross domestic product and housing market.

Ouvrez votre compte bancaire en ligne depuis la France. What That Means for US. Investors brace for another Bank of Canada bond taper Back to video.

LONDON April 28 Reuters - The Bank of Canada set the taper ball rolling last week becoming the first major central bank to cut back on pandemic-era. Additionally although they slightly lowered their 2021 annual GDP to six they raised they 2022 forecast to 45. An improved economic outlook and growing confidence among central bankers have created the conditions in which the Bank of Canada is now comfortable paring back the pace of bond purchases by 3 billion.

The Bank of Canada will taper its asset purchase programme again next quarter and raise interest rates earlier than previously predicted amid expectations for a robust economic recovery after a recent downturn a Reuters poll showed. Still it would be a mistake to assume that central bankers enjoy being active players in debt markets. Soyez prêt pour votre nouvelle vie.

Ouvrez votre compte bancaire en ligne depuis la France. We highlighted above how a well-paced economic recovery provides the main reasoning behind trimming bond purchases and reducing the size of the balance sheet.

Kuroda Rebuffs View Boj Undergoing Fed Style Tapering Investing Theories Japan

Treis Trapezes Toy City Syzhtoyn Na Er8oyn Ellada Bank Of England Investment Services London City

Https Think Ing Com Uploads Hero W1200 280120 Image Canada Jpg

الدنمارك تكشف عن تصميمات الجزر الجديدة قبالة سواحل كوبنهاجن تعمل الحكومة الدنماركية وسلطات كوبنهاجن على إنشاء مجتمع ومش Industrial District Denmark Island

U K Construction Slumped In March As Snow Stalled Projects Construction Stall Slumping

U K Retail Sales Lose Steam As Firms Shoppers Fret Over Prices In 2021 Retail Sales Retail Picture

Global Growth And Optimism Slide To Two Year Lows But Prices Rise At Record Rate Optimism Global Growth

European Central Bank S Mersch Says Banks Should Segregate Crypto Trading Investing In Cryptocurrency Cryptocurrency Central Bank

Snb Keeps Ultra Loose Stance With Little Sign Of Inflation Surge In 2021 Stance Property Marketing Signs

Canada No Longer Needs Strong Stimulus Central Bank Says Raster To Vector Bank Jpg To Vector

Pin On Semiotics September 2021

New Zealand Investor Confidence Hit By Lower Term Deposit Rates Lowest Terms Investors Deposit

Once Crisis Tools Have Served Their Purpose Central Banks Should Scale Them Back By Wolf Richter For Wolf Street The Bank In 2021 Balance Sheet Bank Corporate Bonds

U S Job Market Rapidly Healing In June Fed Researchers Say Waitstaff Marketing Jobs Healing

Https Think Ing Com Uploads Hero W800h450 280120 Image Canada Jpg